Smarter Workers’ Compensation Insurance

Save on your workers’ compensation insurance with Foxquilt’s competitive pricing

As Featured In

Rated 5 stars

As Featured In

Rated 5 stars

What makes Foxquilt different?

Tailored To Your Business

Create Your Policy In Just A Few Taps

Only Pay For What You Need

Rated 5 stars by business owners

See why other business owners, just like you, love Foxquilt's smarter coverage, 5-star service and insurance built for them.

Quickest and easiest insurance I’ve ever gottenread more

The form was easy to complete to get a quote...This was a quick and easy process, and the prices are fair and affordable. I'm really happy with the whole process.read more

So easy to get a quote and amazing prices. Would recommend to anyone trying to get your small business insurance for the first time.read more

Save on smarter business insurance for Workers' Compensation

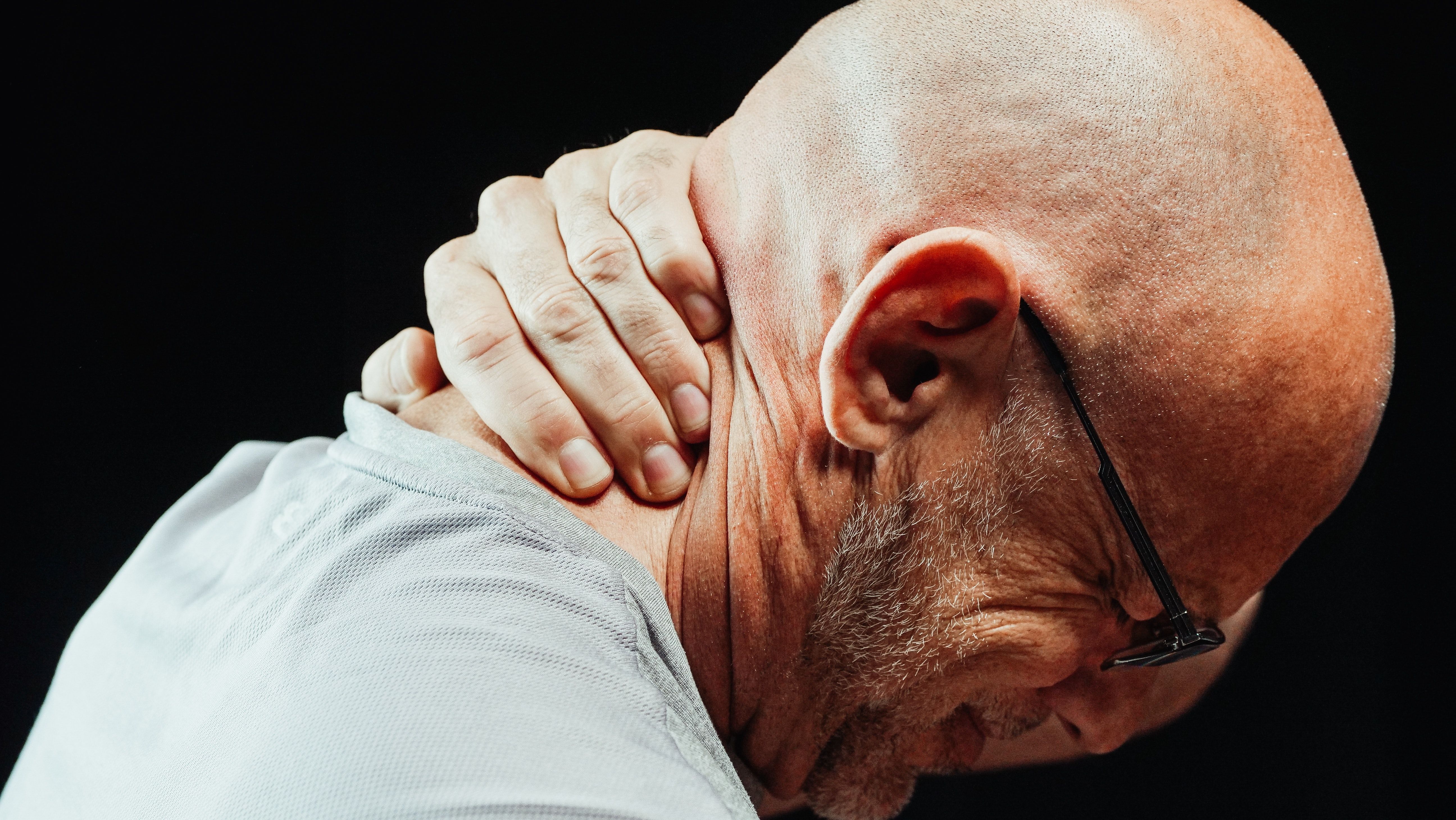

What is Workers’ Compensation Insurance for Businesses?

Workers’ compensation insurance (workman’s comp or workers’ comp) protects and supports your employees by providing benefits if they suffer a workplace injury or illness. Typically these benefits include:

- Medical care

- Lost wages due to time off

- Permanent disability compensation

- Retraining benefits

- Death benefits

Examples of Workers’ Comp Insurance Claims

Medical Expenses

Permanent Injury

Retraining Benefits

Your office assistant unfortunately has been using improper typing techniques and develops carpal tunnel syndrome. Workers’ compensation insurance can help cover the costs of your employee seeking treatment with a physician and receiving a wrist splint, as well as the wages they lost while recovering.

Does Your State Require Workers' Compensation Coverage?

Laws around workers' compensation can vary from state to state.

Use the dropdown menu to check your state's regulations:

Alabama

Here’s what you need to know about Alabama’s workers’ compensation law:

Alabama workers’ compensation law requires all employers that regularly employ 5 or more employees to get workers’ compensation insurance coverage. This includes part-time workers, corporate officers and members of an LLC as employees.

Employees who are not required to have workers’ comp coverage include:

- Domestic employees working in private homes

- Farm workers

- Casual employees, who don’t have guaranteed work hours

- Municipalities with less than 2,000 residents

Frequently Asked Questions

Does My State Require Workers’ Compensation Insurance?

Workers’ compensation insurance requirements and regulations vary state to state in the US. In fact, Texas and South Dakota are the only states that do not require employers to have workers’ comp insurance. That being said, each state still has unique rules and regulations around who is required to have workers’ compensation so we highly recommend checking your state’s requirements using our drop-down tool above on the page!

What Can Affect the Price of Workers’ Compensation Insurance?

Typically, the cost of workers’ compensation can be affected by the number of employees, total payroll, and where you do business. Because of this, it’s best to make sure the description of the work of your employees matches the description on your workers’ compensation policy. Like most insurance coverages, the amount of risk that may come from the type of work your business does will also have an effect. For example, a company specializing in high-rise window cleaning is likely going to have a higher rate per employee than a customer service call center.

What Does Workers’ Compensation Cover?

Workers’ compensation insurance covers: - Medical care and medical treatment - Lost wages due to time off taken to recover - Permanent disability compensation - Retraining benefits if the injured cannot return to the job they had prior to injury - Death benefits to surviving family or dependents if the employee passes due to the injury (i.e. funeral costs)

Do I need Workers’ Compensation If I Am Self-Employed?

If you’re self-employed without any employees, especially if you’re a partner, LLC member or sole proprietor, you likely will not be required by law to have workers’ compensation business insurance. It’s best to still check what your state’s regulations are or speak with an insurance though; sometimes to can vary by state and industry. Additionally, it’s still a good idea to have workers’ compensation since some clients will ask to see proof of insurance to ensure that you’re covered if you happen to get injured on the job.

Does Workers’ Compensation Cover Subcontractors Working With Me?

No, typically workers’ comp does not cover subcontractors since they’re not your employees of your business. We still recommend reviewing what your state law is since each state has unique requirements that can affect this.